ev tax credit 2022 reddit

This is the Reddit community for EV owners and enthusiasts. 2022 Electric Vehicle Tax Credits.

12 500 Ev Tax Credit Most Likely To Become A Reality R Boltev

State and municipal tax breaks may also be available.

. Everyone please read our Rules and a note from the Mods. In particular the EV credit counts toward the federal income tax of which capital gains is a part but not all federal taxes on income. EV Tax Credit 2022.

Order now and delay delivery to 2022 for the EV credit. Gitlin - Aug 11 2021 118 pm UTC. If your new EV qualifies for a government tax rebate you may be eligible for a federal income tax credit of up to 7500.

If you purchased a Nissan Leaf and your tax bill was 5000 that. 2022 EV Tax Incentive. The credit amount will vary based on the capacity of the battery used to power the vehicle.

The most important thing to be aware of that is left out of. Will the cars currently eligible for the 7500 credit still qualify for the tax credits available when purchased or will. Posted by 1 month ago.

Delivery is sometime this month as early as December 9th. EV tax credit makes final cut7500 for any EV and additional 2500 if built in US and another 2500 if made in a unionized factory. The EV tax credit is currently a nonrefundable credit so the government does not cut you a check for the balance.

Kyle Edison Last Updated. Several months later it seems that revisions to the credit are returning to lawmaker agendas. If help is needed use our stickied support thread or Tesla Support Autopilot for understanding.

1 hour agoTax credits for General Motors vehicles expired in April 2020 and Toyota Motor said this month it expected its credits would expire by the end of 2022 after it hits the cap. Latest on Tesla EV Tax Credit March 2022 The Clean Energy Act for America would have a positive impact on Tesla by making most Tesla cars eligible for an 8000 House version or 10000 Senate version refundable tax credit and handicapping Chinese EVs from entering the US market. Excited to get my first Tesla and have been waiting quite some time for the EV credit to come back.

Lets say you owed the federal government 10000 in taxes when filing your 2021. Toyota is on the verge of running out of federal tax credits in the US as the Japanese company has sold more than 190000 plug-in electric cars. So now you should know if your vehicle does in fact qualify for a federal tax credit and.

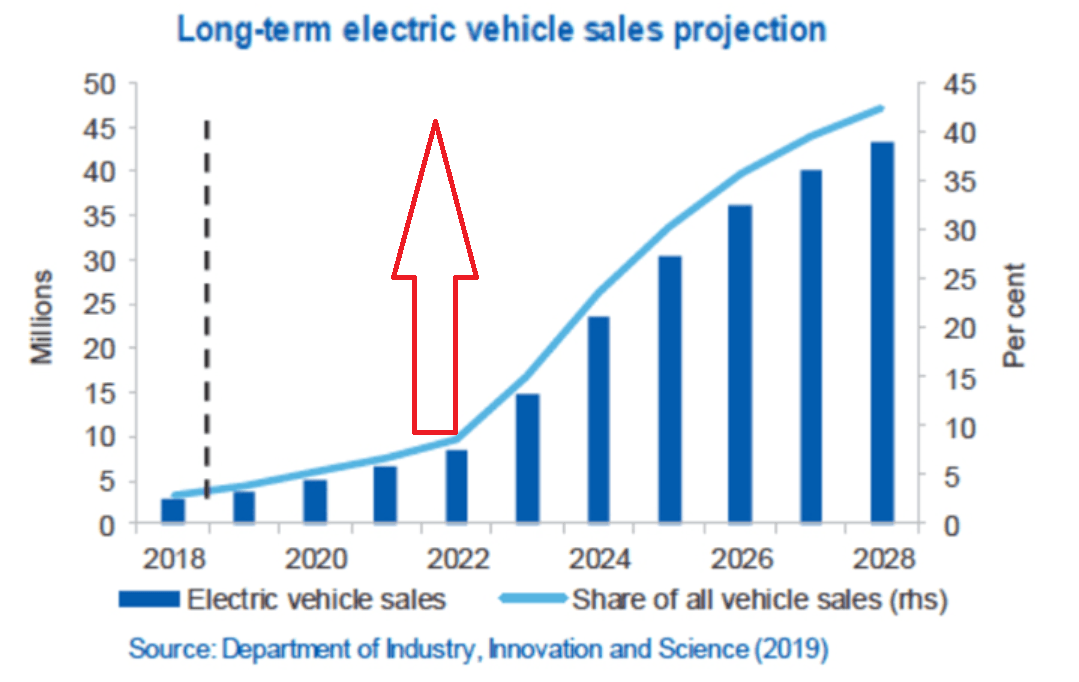

Which EVs Hybrids Qualify. 0 1 minute read. Discuss evolving technology new entrants charging infrastructure government policy and the ins and outs of EV ownership right here.

When you file your taxes for 2021 sometime in the next few months you fill out a form and claim the tax credit. Jan 2022 EV tax credit. Posted by 5 months ago.

It wont be delivered until feb 2022. What happens if new ev tax credit or rebate laws are passed in 2022. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

This is the Reddit community for EV owners and enthusiasts. Ford Motor sold nearly 160000 EVs through the end of 2021 and could hit the cap this year. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned.

The amount of the credit will vary depending on the capacity of the battery used to power the car. The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors. The credit applies to the year you buy the vehicle and your tax credit is capped at how.

The electric vehicle tax credit has finally been made more accessible to taxpayers with the ability to claim up to 12500. Ive read a lot of posts and comments here and still have a question. Ordered a bmw x45e that currently qualifies for the 7500 tax credit.

EV Tax Credit 2022. Here are the currently available eligible vehicles. I am considering delaying my delivery until January to like many benefit from the tax incentive.

Latest on Tesla EV Tax Credit March 2022 The Clean Energy Act for America would have a positive impact on Tesla by making most Tesla cars eligible for an 8000 House version or 10000 Senate version refundable tax credit and handicapping Chinese EVs from entering the US market. Updated 342022 Latest changes are in bold Other tax credits available for electric vehicle owners. EV tax credit counts toward all federal income taxes owed.

Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500. Given both the House and Senate credits IF PASSED are point-of-sale credits rather than tax credits. Just want to jump in that this is correct but relies on a pretty correct understanding of what federal income tax means.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. I have already benefited from prior tax incentives when I bought my first Model 3 in 2019. What Is the New Federal EV Tax Credit for 2022.

If youre like most people you use turbo tax and you can indicate that you bought an EV through their series of questions. January 13 2022 - To get the federal EV tax credit you have to buy a new and eligible electric car. I have already ordered my Tesla Model 3.

The best part about this tax credit is that its fully refundable. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. President Bidens EV tax credit builds on top of the existing federal EV incentive.

2022 ev tax credit changes and grandfathering. Updated March 2022. Jan 05 2022 at 829pm ET.

Discuss evolving technology new entrants charging infrastructure government policy and the ins and outs of EV ownership right here. Should I wait for it. However Tesla does not employ unionized labor so Tesla would be.

No EV tax credit if you earn more than 100000 says US Senate The amendment would also limit the tax credit to EVs that cost less than 40000. Federal EV tax credits of 2500-7500 are available for new EVs and plug-in hybrids but not for hybrids. You only get the full 7500 tax credit if you have 7500 or more in tax liability.

Current Ev Registrations In The Us How Does Your State Stack Up Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Ev Tax Credit 2022 Question R Teslamodel3

Smart Car Dumb Car Which Would You Prefer

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt R Electricvehicles

Ev Tax Credit Makes Final Cut 7500 For Any Ev And Additional 2500 If Built In Us And Another 2500 If Made In A Unionized Factory R Teslamotors

Ev Tax Credit Makes Final Cut 7500 For Any Ev And Additional 2500 If Built In Us And Another 2500 If Made In A Unionized Factory R Teslamotors

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption R Rav4prime

A Look At 6 Etfs That Cover The Electric Vehicles Trend Seeking Alpha

Update On Ev Credit Clean Energy For America Act R Teslalounge

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Jan 2022 Ev Tax Credit R Electricvehicles

Is House Ev Tax Credit Proposal Targeting Tesla Huge Increase For Unions

Melvin Capital Hedge Fund Targeted By Reddit Board Closes Out Of Gamestop Short Position

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek